The dating app economy is thriving—but behind the scenes, it's not just about swipes and matches.

Successful dating platforms turn engagement into revenue through a mix of proven monetization models. Whether you’re building a niche app or scaling a global platform, understanding how to monetize without compromising user experience is key.

Here’s a breakdown of the core revenue models most dating apps rely on today—from subscriptions and microtransactions to advertising, affiliate income, and beyond. Each model offers its own strengths—when combined strategically, they can transform your app into a highly profitable business.

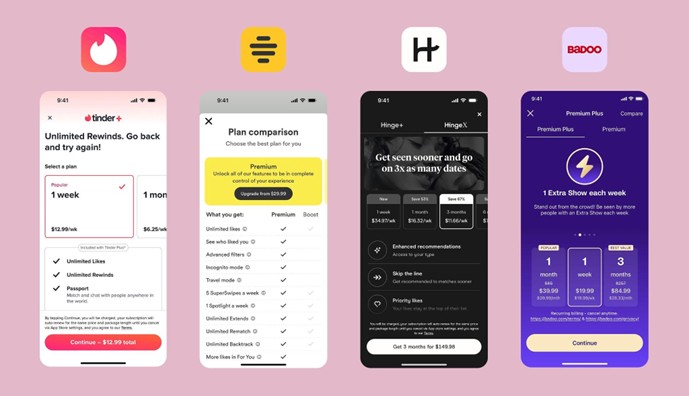

Subscription-Based Revenue Models

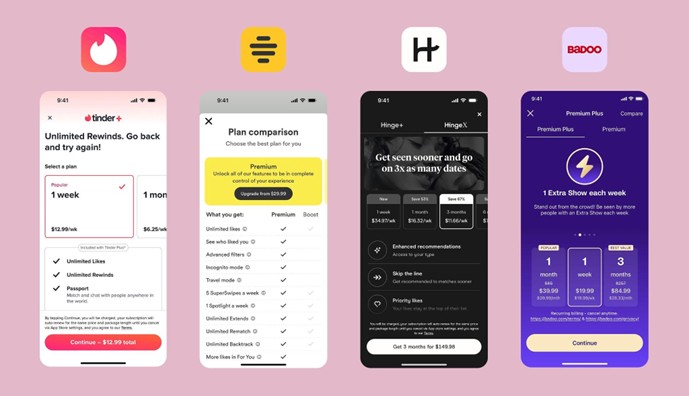

Subscription models remain the backbone of most dating app monetization strategies.

By offering core features—such as swiping and messaging—for free, these apps attract a wide user base while reserving advanced perks for paying subscribers. Free users also help generate referrals, typically contributing between 15%-25% of the value of premium subscribers.

Premium plans vary from app to but, but they will typically unlock advanced features like unlimited swipes, profile boosts, access to additional filters, and global matching capabilities. The integration of advanced AI matchmaking algorithms has been driving higher demand for premium subscriptions, too.

Tiers can range from budget-friendly monthly options to VIP memberships that offer added benefits, such as early message access and priority visibility, but most subscription plans are priced between $8 and $15 per month. They’re designed to cater to various user preferences and budgets while still generating steady recurring revenue from renewals.

The global dating app market is expected to hit $3.45 billion by 2029, which highlights the profitability of well-executed subscription strategies. And given that subscription spending is projected to hit $1.5 trillion by 2025, apps that offer stronger value and clear differentiation in their plans are well-positioned to capture ongoing interest and revenue.

Ready to turn your app idea into a profitable business? Our custom app development services are built for founders who want more than just downloads—we help you launch with UX and revenue in mind.

In-App Advertising Strategies

When implemented thoughtfully, advertising can become a powerful revenue stream without disrupting user experience. The key lies in native ad formats that blend seamlessly into the app’s interface—such as swipeable cards, in-feed placements, or branded content modules.

Native advertising is particularly advantageous here because it nurtures trust among users by being less intrusive than traditional ads. Additionally, native ads typically follow a CPC payment model, which can be a cost-effective alternative to impression-based advertising.

Some dating apps also use sponsored profile boosts as a monetization strategy—a hybrid between ads and in-app purchases—where users can pay for increased visibility in search results or match suggestions for a limited time.

Boosted profiles tend to get up to 10 times more views, further increasing the user's chances of matching successfully. As for app developers, it creates a lucrative revenue stream—all while integrating seamlessly with user intent and maintaining a pleasant app experience.

Video ads—typically 3 to 6 seconds long—are also gaining traction due to their ability to capture attention without interrupting user flow, especially when paired with interactive CTAs.

Of course, precise demographic targeting based on age, gender, location, and interests is key for relevant ad placements, maximizing value for advertisers and generating revenue for dating apps.

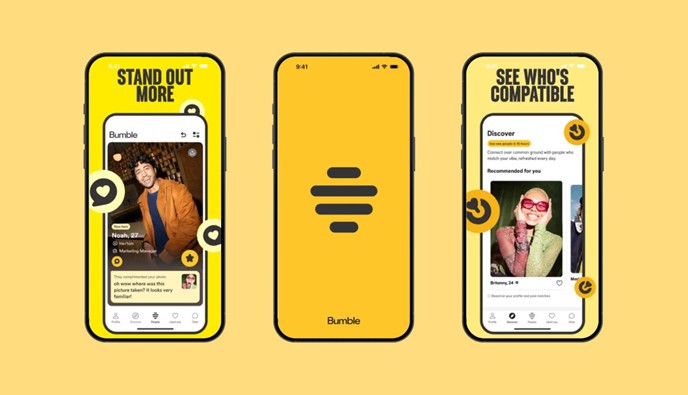

Monetizing Through Premium Features

Nearly every successful dating app uses premium features to drive revenue beyond subscription-based models, offering users additional flexibility and personalization.

Premium subscribers enjoy exclusive perks, including incognito browsing, advanced match filters, privacy features like two-factor authentication, read receipts, and AI-powered compatibility insights, along with an ad-free experience.

Offering shorter billing cycles, time-limited free trials, or à la carte upgrades can help drive conversions from hesitant users.

Features that focus on time-saving—like compatibility scoring and access to VIP events—tend to resonate especially well with Gen Z audiences who value customization and control.

Ultimately, clearly differentiated premium offerings can improve user satisfaction and significantly boost your app's revenue potential.

Revenue From In-App Purchases

Premium subscriptions are a significant revenue driver for dating apps—but strategically designed in-app purchases can also improve profitability.

Microtransactions provide “quick wins” for both users and developers. Think profile boosts, Super Likes, and virtual gifts—features that temporarily increase profile visibility or allow users to express interest more strongly.

Limited-time offers and niche features—like virtual event tickets or specialized options for the LGBTQ+ community—can further incentivize users to engage with the app. In-app purchases can boost immediate revenue and, at the same time, promote long-term user engagement.

These one-time purchases often complement subscriptions and can be bundled into curated packages to encourage higher spend. With over 300 million users worldwide, the scale of potential revenue from these microtransactions is substantial.

Case in point:

Tinder's effective use of in-app purchases contributed to it becoming the highest-grossing dating app in the world in 2024.

Thinking long-term? App Makers LA can create a mobile app with built-in analytics, so you can see what features drive revenue—and double down on what works. Let’s talk!

Affiliate and Partnership Income

Everyone aims for profitability with their dating app—and while subscription models and in-app purchases are common revenue streams, affiliate and partnership income provides an alternative avenue for growth.

This approach involves promoting complementary services and brands—such as relationship coaching, lifestyle brands, or event platforms—in exchange for referral commissions. Dating remains an evergreen niche with significant revenue potential, making it an attractive choice for generating passive income.

Keep in mind that affiliate software will be essential for effectively managing and optimizing these affiliate programs.

Special Events and Exclusive Content Revenue

Beyond conventional subscriptions, advertising, and affiliate income, hosting special events and providing exclusive, members-only content can create substantial revenue opportunities for dating apps.

By organizing virtual mixers, expert workshops, and in-person meetups, you can charge participants fees ranging from $10 to $50 per event, potentially boosting your earnings by 15-20%. These formats not only generate direct income but deepen user engagement, too.

Here are some profitable strategies to consider:

- Virtual speed dating or mixers with participant fees

- Exclusive coaching sessions focused on profile optimization or relationship skills

- Sponsored events, either virtual or in-person, featuring brand partnerships (companies are eager to support events that offer them targeted visibility)

- Premium subscription benefits that grant access to VIP events

Non-paying users represent a large audience that can be converted into paying customers with attractive freemium-model promotions and event participation incentives. And with roughly 35% of online daters already paying for premium features, there's potential to attract even more users through special events and exclusive content.

It’s not just about revenue—these strategies can help differentiate your dating app, promoting greater user engagement and loyalty in the long term.